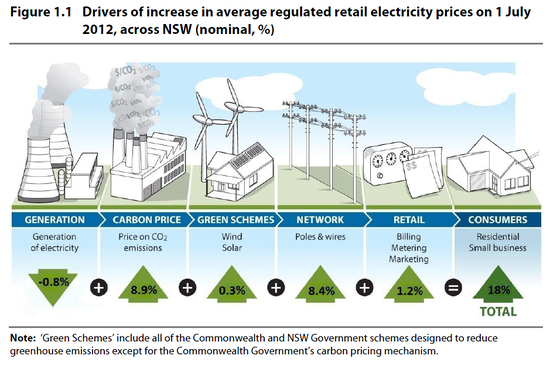

The Effect of the Carbon Price on Electricity Prices

MCJ Posted on

MCJ Posted on  Tuesday, August 7, 2012 at 21:32

Tuesday, August 7, 2012 at 21:32

Updated on Friday, September 13, 2013 at 18:11 by

MCJ

MCJ

Updated on Sunday, November 3, 2013 at 22:39 by

MCJ

MCJ

In an otherwise good article, Peter Martin today wrote that

[the TD Securities Melbourne Institute price index] reports a jump in electricity prices of 14.9 per cent and a jump in household gas prices of 10.3 per cent, almost all of which would have been due to the carbon tax. [emphasis mine]

This is incorrect, and, unfortunately, he is not the first journalist to make this mistaken claim. Evidence to the contrary be found in, for example, the reports from the relevant authorities in states that regulate their electricity prices:

New South Wales

IPART’s “Final Report – Changes in regulated electricity retail prices from 1 July 2012”

Australia,

Australia,  carbon pricing,

carbon pricing,  energy

energy